Table of Contents

Analyze360™ EV Buyer Behavior Study

The electric vehicle (EV) market has been experiencing robust growth in recent years. As of 2023, the global EV market is valued at approximately USD 388.1 billion and projected to reach USD 951.9 billion by 2030.1 In 2022, EV sales globally exceeded 10 million, with 14% of all new cars sold being electric, a significant increase from 9% in 2021.2 Specifically in the United States, the EV market has broken records with just under 918,500 light electric vehicle sales in 2022.3

EV market projected to reach

$951 Billion by 2024

For auto manufacturers, understanding EV buyer behavior is pivotal. It not only helps them to align their product offerings with consumer preferences but also aids in shaping marketing strategies that can effectively reach potential buyers. With the influx of more than 90 new EV models expected to hit the U.S. market through 2026,4 understanding who the EV buyers are becomes even more crucial.

Despite the growth in the EV market, there is a problem that is becoming increasingly apparent: the growing backlog of unsold electric vehicles. This issue indicates a disconnect between the vehicles being produced and the preferences or purchasing capability of the consumers.4

This study aims to delve deeper into the EV buyer behavior, with the goal of identifying distinct markets within the EV buyer population. By doing so, auto manufacturers can craft more targeted strategies and address the current problem of unsold electric vehicles.

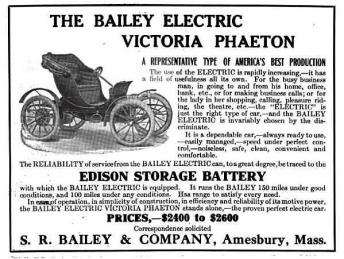

A Brief History of Electric and Hybrid Vehicles

The journey of electric and hybrid vehicles dates to the late 19th century when early car designers were looking for sufficient power to move their carriages.5 However, the first significant milestone was achieved in 1900 by Ferdinand Porsche who developed the System Lohner-Porsche Mixte, the world’s first hybrid vehicle.6 The era of mass-produced hybrid vehicles began when Toyota launched Prius in Japan in 1997.7

The evolution of purely electric vehicles also has a rich history, starting around 1884 when Thomas Parker deployed electric-powered trams and built prototype electric cars in England.8 These developments laid the foundation for the modern EV market.

American auto manufacturers have made significant investments in EV technology, recognizing its potential and the shift in consumer preferences towards greener alternatives. General Motors, for instance, announced plans to invest $27 billion in electric and autonomous vehicles by 2025.9 Similarly, Ford has committed to spend more than $30 billion on electric vehicles by 2025.10

Tesla has played an instrumental role in the success story of EVs. The company, under Elon Musk’s leadership, brought a paradigm shift in the auto industry by making electric cars desirable and technologically advanced. With the launch of models like the Tesla Roadster, Model S, Model 3, and Model X, Tesla not only demonstrated the viability of electric cars but also set new standards for range, performance, and safety in the EV market.11

The Impact of Trends on Auto Industry Stakeholders

These trends have far-reaching impacts. For the auto industry, the transition to electric vehicles represents both a challenge and an opportunity. Companies must adapt to new technologies and consumer demands, which can be costly and complex. However, this also opens new markets and possibilities for growth.

For investors, the rise of EVs has created a new and rapidly growing sector with significant potential for returns. However, it also comes with risks, given the high levels of competition and technological uncertainty.

Workers in the auto industry are also affected, as the shift to EVs could lead to job displacement in traditional auto manufacturing while creating new jobs in EV production. Reskilling and training programs may become increasingly important to help workers adapt.

Lastly, for the public, the growth of the EV market is largely beneficial. It offers consumers more choices and the opportunity to choose vehicles that are better for the environment. However, issues such as the affordability of EVs and access to charging infrastructure remain challenges that need to be addressed.

Prior Studies on US EV Consumer Behavior

Several studies have been conducted to understand consumer behavior towards EVs in the US. One comprehensive analysis, published in the International Journal of Consumer Studies, compared the cultural and psychological characteristics affecting the purchase behavior and satisfaction of electric vehicles between the US and China.12 The study suggested that American consumers are influenced by a variety of factors, including cost, practicality, and environmental impact.

In another study published in the Journal of Business Research, researchers aimed to map the field of electric vehicle consumer behaviors. The study found that consumer attitudes towards EVs are complex and multi-faceted, highlighting the need for more targeted and effective marketing strategies.13

Research has also applied theoretical models to understand buyer behavior and decision-making in the US EV market. One study used an extended version of the Theory of Planned Behavior model to predict consumers’ intention to adopt hybrid electric vehicles.14

Another study adopted an integrative approach to study consumer behavior towards plug-in hybrid electric vehicles. Their findings suggested that the customers usually weigh the initial higher cost of these vehicles against the long-term benefits, such as fuel cost savings and environmental impact.15

The influence of environmental concerns on US consumers’ purchasing decisions has been explored in several studies. A study published in Energy Policy found that cost is the main attribute governing vehicle purchase decision, but the desire to reduce environmental impact is also a significant factor in the decision to purchase EVs.16

Methodology and Limitations

In this study, we will utilize a dataset that captures purchase patterns for various makes and models of electric vehicles (EVs). This data includes information about the Tesla Models 3 & S (41 buyers) hereafter collectively referred to as Tesla, Toyota Prius (58 buyers), Nissan Leaf (26 buyers), and Chevrolet Volt (40 buyers). The vehicles were drawn from a random sample of a national database of automobile ownership records.

American Lifestyles™ 2023* is a consumer classification system from Analyze360™. It segments the US population into 32 sociometric and psychographic clusters using a combination of age, income, urbanicity, household composition, buying patterns and personal interests. This report shows the top five Lifestyles categories for each automotive data set.

To identify distinct categories of buyers, we will use a combination of statistical techniques and machine learning algorithms. This includes cluster analysis, which groups buyers based on shared characteristics, and decision tree analysis, which identifies key variables that differentiate one group of buyers from another. Additionally, we may employ predictive modeling techniques like logistic regression or neural networks to predict future buying behaviors based on past patterns.

While our methodology is robust, it is important to acknowledge the limitations of this study.

1) Our data is limited to documented purchases of EVs, which may not capture the full spectrum of consumer interest in these vehicles. For instance, potential buyers who researched EVs but ultimately did not purchase one are not represented in our data.

2) While our analytical techniques can identify patterns and correlations, they cannot definitively establish causation. For example, while we might find that buyers of a certain demographic tend to prefer a particular EV model, we cannot conclusively say that demographic factors cause this preference without further research.

3) The relatively small sample sizes of EV owners may limit the generalizability of our findings to the wider population. While we have taken steps to ensure a diverse sample, it is possible that certain demographics or regions are underrepresented in our data.

4) Our findings are subject to the accuracy and completeness of the data we have used. If there are errors in the data or significant gaps, this could affect the validity of our results. The data are also limited to purchases made prior to 2021, which may not reflect current trends in the EV market.

5) Finally, consumer preferences and behaviors are constantly evolving, which means our findings may not be applicable in the future. To address this, we will regularly update our research.

The Top 5 Lifestyle Categories for Each Model

To explore the lifestyle preferences of electric vehicle (EV) owners, we will analyze the top five American Lifestyles™ categories linked to each EV model. Our goal is to provide a comprehensive understanding of different consumer groups. Through this effort, we aim to offer a nuanced perspective that captures the essence of their preferences and choices.

Tesla Models 3 & S

-

McMansions and Private Schools (21.95% of sample): Upper-income suburban families (36-65), earning over $250K. Enjoying a life of exclusivity, they invest in oversized homes, upscale furnishings, high-end appliances, children’s activities, and private schooling. They travel extensively and frequently shop online for luxury brands. Located in Beaumont, TX; Great Falls, VA; and Westport, CT. Mostly college graduates, they typically drive an Acura MDX and watch AMC.

-

Active Grandparents (19.51% of sample): High net worth urban seniors (66+), earning between $75K-150K, and living active lifestyles into retirement. They splurge on automobiles, home furnishings, cruises, and warm-weather travel destinations. They are avid readers and frequent shoppers at high-end malls and department stores. Located in Delray Beach, FL; Peoria, AZ; and Orange, CA. Education is a mix of high school, college, and graduate school. They typically drive a Toyota Camry and watch the History Channel.

-

Soccer Camps and SUVs (12.2% of sample): Urban families with teenagers (36-55), earning between $50K-75K and enjoying a mix of traditional middle-class living with some luxury amenities. They invest heavily in financial and retirement products, home improvement, clothing, and lifestyle brands. Their shopping habits balance between online and discount retailers. Located in Moreno Valley, CA; St Paul, MN; and Worcester, MA. Mostly college-educated, they typically drive a Ford Explorer and watch Nickelodeon.

-

Young Power Couples (9.76% of sample): Successful suburban couples (30-45), earning between $75K-150K in second cities. They spend heavily on fashion, home improvement, personal services, and mass-market luxury goods. They love the outdoors and exercise, and many spend on both gym memberships and fitness equipment. Located in Olympia, WA; Kalamazoo, MI; and Knoxville, TN. Education is a mix of high school and college graduates. They typically drive a Toyota Tundra and watch SyFy.

- Urban First Homeowners (4.88% of sample): Young urban singles (24-45), earning between $35K-50K who have just acquired their first home. They are middle-class earners, investing heavily in their nest eggs and buying furniture, home improvement supplies, and household items at higher-than-average rates. They prefer green products and brands that support their social causes but love a bargain as well. Located in Akron, OH; Rochester, NY; and Santa Fe, NM. Education is a mix of high school and college graduates. They typically drive a Toyota Corolla and watch Oxygen.

Overall, this profile paints a picture of a financially secure, culturally aware, and family-oriented audience with a preference for liberal political causes. They are likely to engage in activities related to art, travel, and cultural experiences, with a preference for online shopping and a sophisticated lifestyle. They may also have diverse interests, including hobbies like collecting and potentially unique pets.

In addition to the findings in the lifestyle report, the sociometric data provide further insights into their characteristics. In this specific example, the demographic of Tesla buyers is predominantly composed of males aged 35 to 75, with the highest percentage falling within the 36-50 age range (35%), followed by the 51-65 age range (25%), and the 66-75 age range (22%). They have a higher household income, net worth, and home value compared to the baseline.

This aligns with the premium positioning of Tesla’s electric vehicles in the market. The data indicates that Tesla’s target market is not only environmentally conscious but also affluent, aligning with the brand’s high-end, sustainable image.

Toyota Prius

-

Bundles of Joy (20.69% of sample) Young suburban couples (18-29), transitioning to parenthood. Primarily renters and homeowners earning $50K-75K, they invest heavily in housing, furnishings, automotive, and childcare. They balance career advancement with parenting, relying on convenience foods and dining out. Located in Sioux City, IA; Pensacola, FL; and Conroe, TX. They are a mix of high school and college-educated, typically drive a Ford Fusion, and watch PBS Kids.

-

McMansions and Private Schools (15.52% of sample) Upper-income suburban families (36-65), earning over $250K. Enjoying a life of exclusivity, they invest in oversized homes, upscale furnishings, high-end appliances, children’s activities, and private schooling. They travel extensively and frequently shop online for luxury brands. Located in Beaumont, TX; Great Falls, VA; and Westport, CT. Mostly college graduates, they typically drive an Acura MDX and watch AMC.

-

Buying in Bulk (10.34% of sample) Suburban and rural middle-income families (36-65), earning $50K-75K. Prioritizing their children’s needs, they are heavy debt users, financing home furnishings, vacations, and family vehicles. They shop at discount retailers, department stores, and online retailers, and buy in bulk to economize. Located in Augusta, GA; Ventura, CA; and Duluth, MN. They have a mix of high school and college degrees, typically drive a Ford Escape, and watch Freeform.

-

Working Past Retirement (8.62% of sample) Aging boomers (66-75), earning $50K-75K, financially struggling due to heavy credit use. Many still have outstanding mortgages and work past retirement age. They spend on home improvement, travel, and entertainment, and value staying connected through cell phones and social media. Located in Columbus, GA; Carson City, NV; and Anderson, IN. They have a mix of high school and college degrees, typically drive a Chevrolet Equinox, and watch TLC.

-

Play Dates and Promotions (8.62% of sample) Young suburban families (30-45), earning $50K-75K. As their children reach school age and their careers advance, they spend on clothing, toys, digital entertainment, household furnishings, and practical automobiles. They value an active lifestyle and spend on gyms, gourmet foods, and sporting goods. Located in Anchorage, AK; Fairfax, VA; and Olympia, WA. Mostly college-educated, they typically drive a Honda Odyssey and watch the Disney Channel.

These findings suggest that Prius buyers tend to be individuals who are socially aware (as indicated by their interest in current affairs and political contributions), have diverse interests (such as photography, cooking, and gardening), and are financially active (as indicated by their investment activities and credit card ownership). They also exhibit a preference for online shopping and have a diverse range of hobbies and interests.

The sociometric data also suggests a more balanced distribution between male and female buyers of the Prius. The age range of the group varies from 26 to over 76. The largest percentage falls between 66 and 75 (33%), followed by those aged 76 and above (23%), 36 to 50 (20%), 51 to 65 (17%), and 26 to 35 (5%).

This data indicates that the Prius appeals to a wide demographic, but it’s particularly popular among older individuals. Its eco-friendly nature, coupled with its reliability and economy, may make it an attractive choice for this demographic.

Nissan Leaf

-

Bundles of Joy (23.08% of sample): Suburban couples aged 18-29 with infants and toddlers. As they transition to parenthood and advance their careers, they make significant purchases in housing, furnishings, automotive, and childcare. These young adults earn between $50K-75K and are located in Sioux City, IA; Pensacola, FL; and Conroe, TX. Their education is a mix of high school and college graduates. They typically drive a Ford Fusion and watch PBS Kids.

-

Strollers and City Parks (15.38% of sample): Urban young families aged 18-45 struggling to make ends meet in low-skill service and retail jobs. Despite limited means, they spend heavily on food, clothing, toys, and personal care items for their children. These families earn $35K or less and are based in Paterson, NJ; Philadelphia, PA; and Long Beach, CA. Most are high school educated. They typically drive a Hyundai Sonata and watch Cartoon Network.

-

McMansions and Private Schools (15.38% of sample): Wealthy suburban American families aged 36-65 who enjoy exclusivity and status. They spend heavily on oversized homes, upscale furnishings, high-end appliances, children’s activities, and private schooling. These families earn $250K or greater and are located in Beaumont, TX; Great Falls, VA; and Westport, CT. They are predominantly college-educated, with 14% having attended graduate school. They typically drive an Acura MDX and watch AMC.

-

Working Past Retirement (15.38% of sample): Aging boomers aged 66-75 still working due to heavy credit use. They spend on home improvement, furnishings, domestic travel, and entertainment. These older adults earn between $50K-75K and are located in Columbus, GA; Carson City, NV; and Anderson, IN. Their education is a mix of high school and college graduates. They typically drive a Chevrolet Equinox and watch TLC.

-

Up-and-Coming Elites (11.54% of sample): Young adults aged 25-45 who are financially successful but still living in rented or shared accommodation due to high college debt. They are politically active, tech-savvy, and prefer products that align with their social consciousness. These individuals earn between $150K-250K and are based in Seattle, WA; Stamford, CT; and Arlington, VA. They are college-educated. They typically drive an Audi Q5 and watch BBC America.

Overall, this profile suggests that Nissan Leaf buyers includes young, career-focused individuals with a diverse range of interests including technology, finance, fashion, and various recreational activities. They also show a propensity for higher-end lifestyle choices, possibly indicating a higher disposable income. Additionally, there is an inclination towards progressive political views and a focus on personal well-being.

However, the detailed sociometric data also indicate that this sample is twice as likely to be male, with the highest percentage falling within the 66-75 age range (39%), followed by the 51-65 age range (30%), and evenly distributed (7% each) in the 36-50 and the 76+ age ranges.

While Nissan Leaf might appeal to younger individuals due to its alignment with progressive values and technology interests, the actual buying power lies with older males. These older buyers might have more financial stability, allowing them to invest in higher-end lifestyle choices like eco-friendly vehicles. This could be indicative of changing trends within the automobile market, where the appeal of sustainable technology is expanding beyond younger demographics.

Chevrolet Volt

-

McMansions and Private Schools (35% of sample): Comprising upper-income suburban American families aged 36-65, these households enjoy exclusivity, status, and privilege. They spend heavily on their oversized homes, upscale furnishings, high-end appliances, children’s activities, and private schooling. These families earn $250K or greater and are located in Beaumont, TX; Great Falls, VA; and Westport, CT. Predominantly college-educated, 14% have attended graduate school. They typically drive an Acura MDX and watch AMC.

-

Soccer Camps and SUVs (17.5% of sample): These are urban families with teenagers aged 36-55. They enjoy a mix of traditional middle-class living with some luxury amenities, investing heavily in financial and retirement products, home improvement, clothing, and lifestyle brands. Despite earning between $50K-75K, they manage credit well and shop online and at discount retailers. They live in Moreno Valley, CA; St Paul, MN; and Worcester, MA. Most are college-educated. They typically drive a Ford Explorer and watch Nickelodeon.

-

Active Grandparents (12.5% of sample): High net worth urban seniors aged 66+ who continue to lead active lifestyles into retirement. They splurge on automobiles, home furnishings, cruises, and domestic travel to warm-weather destinations. Located in Delray Beach, FL; Peoria, AZ; and Orange, CA, they earn between $75K-150K. Their education is a mix of high school, college, and graduate school. They typically drive a Toyota Camry and watch the History Channel.

-

Bundles of Joy (7.5% of sample): Suburban couples aged 18-29 with infants and toddlers. As they transition to parenthood and advance their careers, they make significant purchases in housing, furnishings, automotive, and childcare. These young adults earn between $50K-75K and are located in Sioux City, IA; Pensacola, FL; and Conroe, TX. Their education is a mix of high school and college graduates. They typically drive a Ford Fusion and watch PBS Kids.

-

Strollers and City Parks (5% of sample): Urban young families aged 18-45 struggling to make ends meet in low-skill service and retail jobs. Despite limited means, they spend heavily on food, clothing, toys, and personal care items for their children. These families earn $35K or less and are based in Paterson, NJ; Philadelphia, PA; and Long Beach, CA. Most are high school educated. They typically drive a Hyundai Sonata and watch Cartoon Network.

Overall, the Chevrolet Volt attracts a diverse buyer profile due to its various attributes—eco-friendliness, safety, reliability, spaciousness, and cost-effectiveness. Its wide appeal underscores its versatility as a vehicle suitable for different life stages and lifestyles.

The sociometric data, however, reveals a more specific buyer profile. The majority of Chevrolet Volt buyers are male, with the largest age group being 51-65 years old (48%). This is followed by the 66-75 age group (27%), the 36-50 age group (12%), and the 76+ age group (5%).

This indicates that while the Chevrolet Volt appeals to a broad spectrum of individuals, middle-aged to older males are the primary buyers. It may suggest that these features—eco-friendliness, safety, reliability, spaciousness, cost-effectiveness—are particularly attractive to this demographic.

Comparative Analysis

Comparative Analysis of Tesla vs. Prius

Key Differences

- Age and Family Status: Tesla buyers are more likely to be upper-income suburban families (36-65) or active seniors (66+), while Prius buyers include younger couples transitioning to parenthood (18-29) or young suburban families (30-45).

- Income and Expenditure: Tesla buyers generally have higher incomes, with a significant proportion earning over $250K and investing in luxury goods and experiences. Prius buyers, on the other hand, tend to have more moderate incomes (primarily $50K-150K) and their spending is more oriented towards practical needs like housing, childcare, and family vehicles.

- Location: Tesla buyers are predominantly located in affluent areas like Great Falls, VA; Westport, CT; and Beaumont, TX. Prius buyers are spread across a variety of locations, including smaller cities and suburban areas like Sioux City, IA; Pensacola, FL; and Conroe, TX.

- Interests and Lifestyle: Tesla buyers lead culturally rich lives, engaging in arts, travel, and cultural experiences, with a sophisticated lifestyle. Prius buyers exhibit a wider range of interests, including photography, cooking, gardening, and online shopping.

Key Similarities

- Education: Both Tesla and Prius buyers are typically well-educated, with many holding college degrees or higher.

- Online Shopping: Both groups prefer online shopping and are comfortable making significant purchases online.

- Family Orientation: Both Tesla and Prius buyers seem to place a high value on family, whether that’s expressed through investment in children’s activities and private schooling (Tesla buyers) or through spending on childcare, toys, and family vehicles (Prius buyers).

- Environmental Consciousness: Although it’s more implicitly stated for the Tesla group, both sets of buyers are likely to be environmentally conscious, given their choice of electric or hybrid vehicles. This is more explicitly noted in the Prius buyer profile with their preference for green products.

Comparative Analysis of Tesla vs. Leaf

Key Differences

- Age and Family Status: Tesla buyers largely comprise upper-income suburban families, active seniors, and successful young couples, whereas Nissan Leaf buyers significantly include young suburban couples transitioning into parenthood, working-class urban families, and young adults with high income but still living in rented or shared accommodation.

- Income: Tesla buyers generally have higher incomes, with a significant percentage earning over $250K. In contrast, Nissan Leaf buyers exhibit a wider range of incomes, with key segments earning between $60K-150K.

- Spending Habits: Tesla buyers tend to invest in luxury goods, high-end appliances, and private schooling, among other things. On the other hand, Nissan Leaf buyers, especially those transitioning into parenthood or working past retirement, make significant purchases in housing, furnishings, automotive, and childcare, or spend heavily on home improvement and entertainment.

- Location: Tesla buyers are primarily located in affluent areas or second cities, while Nissan Leaf buyers are spread across suburban areas, smaller cities, and urban locales struggling to make ends meet.

- Education: While both groups are well-educated, Nissan Leaf buyers show a broader mix of education levels, with many having only high school education.

Key Similarities

- Online Shopping: Both Tesla and Nissan Leaf buyers prefer online shopping, indicating comfort with making significant purchases digitally.

- Family Orientation: Both groups place a high value on family, whether expressed through investment in children’s activities and private schooling (Tesla buyers), or spending on childcare, toys, and family vehicles (Nissan Leaf buyers).

- Environmental Consciousness: Both sets of buyers are likely environmentally conscious, given their choice of electric vehicles. This is particularly apparent for Nissan Leaf buyers who prefer products that align with their social consciousness.

- Political Views: Both groups seem to lean towards liberal political causes, indicating a shared progressive mindset.

- Cultural Awareness: Both Tesla and Nissan Leaf buyers are culturally aware, engaging in activities related to art, travel, and cultural experiences.

Comparative Analysis of Tesla vs. Volt

Key Differences

- Age and Family Status: Tesla buyers largely comprise upper-income suburban families, active seniors, and successful young couples, whereas Chevrolet Volt buyers significantly include young suburban couples transitioning into parenthood, working-class urban families, and young adults with high income but still living in rented or shared accommodation.

- Income: Tesla buyers generally have higher incomes, with a significant percentage earning over $250K. In contrast, Chevrolet Volt buyers exhibit a wider range of incomes, with key segments earning between $75K-250K.

- Spending Habits: Tesla buyers tend to invest in luxury goods, high-end appliances, and private schooling, among other things. On the other hand, Chevrolet Volt buyers, especially those transitioning into parenthood or working past retirement, make significant purchases in housing, furnishings, automotive, and childcare, or spend heavily on home improvement and entertainment.

- Location: Tesla buyers are primarily located in affluent areas or second cities, while Chevrolet Volt buyers are spread across suburban areas, smaller cities, and urban locales struggling to make ends meet.

- Education: While both groups are well-educated, Chevrolet Volt buyers show a broader mix of education levels, with many having only high school education.

Key Similarities

- Online Shopping: Both Tesla and Chevrolet Volt buyers prefer online shopping, indicating comfort with making significant purchases digitally.

- Family Orientation: Both groups place a high value on family, whether expressed through investment in children’s activities and private schooling (Tesla buyers), or spending on childcare, toys, and family vehicles (Chevrolet Volt buyers).

- Environmental Consciousness: Both sets of buyers are likely environmentally conscious, given their choice of electric vehicles. This is particularly apparent for Chevrolet Volt buyers who prefer products that align with their social consciousness.

- Political Views: Both groups seem to lean towards liberal political causes, indicating a shared progressive mindset.

- Cultural Awareness: Both Tesla and Chevrolet Volt buyers are culturally aware, engaging in activities related to art, travel, and cultural experiences.

Comparative Analysis of Prius vs. Leaf

Key Differences

- Age and Family Status: Toyota Prius buyers mainly comprise of suburban families transitioning to parenthood, upper-income families, middle-income families, aging boomers working past retirement, and young suburban families. On the other hand, Nissan Leaf buyers significantly include young suburban couples transitioning into parenthood, struggling urban young families, wealthy suburban families, aging boomers working past retirement, and young adults who are financially successful.

- Income: Both Toyota Prius and Nissan Leaf buyers have a wide range of incomes. However, Nissan Leaf buyers include a larger segment of young adults earning greater than $250K.

- Spending Habits: Both groups have diverse spending habits depending on their life stage and income level. However, the Nissan Leaf buyer profile includes a group of young adults who prefer products that align with their social consciousness.

- Location: While both groups are spread across different locations in the U.S., Nissan Leaf buyers include a segment based in urban areas such as Seattle, WA; Stamford, CT; and Arlington, VA.

- Education: Although both groups have a mix of high school and college-educated individuals, the Nissan Leaf buyers include a segment of young adults who are all college-educated.

Key Similarities

- Age Groups: Both Toyota Prius and Nissan Leaf buyers include young couples transitioning into parenthood, upper-income suburban families, and aging boomers working past retirement.

- Income Levels: Both groups include segments earning between $50K-75K and over $250K.

- Spending Habits: Both groups include segments that invest heavily in housing, furnishings, automotive, and childcare. They also have segments that spend on home improvement, travel, and entertainment.

- Location: Both groups include buyers located in Sioux City, IA; Pensacola, FL; Conroe, TX; Beaumont, TX; Great Falls, VA; Westport, CT; Columbus, GA; Carson City, NV; and Anderson, IN.

- Education: Both groups include segments that have a mix of high school and college degrees.

Comparative Analysis of Prius vs. Volt

Key Differences

- Age and Family Status: Toyota Prius buyers mainly comprise of suburban families transitioning into parenthood, upper-income families, middle-income families, aging boomers working past retirement, and young suburban families. On the other hand, Chevrolet Volt buyers significantly include urban families with teenagers, high net worth urban seniors, young suburban couples transitioning into parenthood, and struggling urban young families.

- Income: Toyota Prius buyers generally have a wider range of incomes, from $50K-150K to over $250K. Chevrolet Volt buyers also exhibit a wide range of incomes, but include more segments earning over $175K.

- Spending Habits: Both groups have diverse spending habits depending on their life stage and income level. However, the Volt buyer profile includes a group of high net worth seniors who splurge on automobiles, home furnishings, cruises, and travel, which is not as prominent in the Prius buyer profile.

- Location: While both groups are spread across different locations in the U.S., Volt buyers include a segment based in urban areas such as Moreno Valley, CA; St Paul, MN; and Worcester, MA.

- Education: Although both groups have a mix of high school and college-educated individuals, the Volt buyers include a segment of high-net-worth seniors who have attended graduate school.

Key Similarities

- Age Groups: Both Toyota Prius and Chevrolet Volt buyers include young couples transitioning into parenthood and upper-income suburban families.

- Income Levels: Both groups include segments earning between $50K-150K and over $250K.

- Spending Habits: Both groups include segments that invest heavily in housing, furnishings, automotive, and childcare. They also have segments that spend on home improvement, travel, and entertainment.

- Location: Both groups include buyers located in Sioux City, IA; Pensacola, FL; Conroe, TX; Beaumont, TX; Great Falls, VA; and Westport, CT.

- Education: Both groups include segments that have a mix of high school and college degrees.

Comparative Analysis of Leaf vs. Volt

Key Differences

- Demographics: The Nissan Leaf buyer profile is more diverse, including young adults with high college debt, suburban couples with infants, and aging boomers still working. The Chevrolet Volt, however, attracts a significant portion of upper-income suburban American families, urban families with teenagers, and high net worth seniors.

- Income: Nissan Leaf buyers range from those earning $35K or less to those earning over $250K. Chevrolet Volt buyers also have this range, but additionally include a segment of high-net-worth individuals earning over $175K.

- Location: The Nissan Leaf has a strong presence in suburban and urban areas across the U.S., while the Chevrolet Volt has a more pronounced presence in urban areas and affluent suburbs.

- Spending Habits: Nissan Leaf buyers are characterized by significant spending on housing, furnishings, automotive, childcare, food, clothing, toys, and personal care items. Chevrolet Volt buyers, on the other hand, splurge on their oversized homes, upscale furnishings, high-end appliances, children’s activities, private schooling, financial and retirement products, home improvement, clothing, lifestyle brands, automobiles, and cruises.

- Education: Both buyer profiles include a mix of high school and college graduates. However, the Chevrolet Volt also attracts a segment of high-net-worth seniors who have attended graduate school.

Key Similarities

- Demographics: Both Nissan Leaf and Chevrolet Volt attract suburban couples with infants and toddlers, urban young families struggling to make ends meet, and wealthy suburban American families.

- Income: Both vehicles appeal to a wide income range, from those earning $35K or less to those earning over $250K.

- Spending Habits: Both Nissan Leaf and Chevrolet Volt buyers spend heavily on housing, furnishings, automotive, and childcare. Additionally, they both invest in home improvement and entertainment.

- Location: Both vehicles have buyers located in Sioux City, IA; Pensacola, FL; Conroe, TX; Beaumont, TX; Great Falls, VA; and Westport, CT.

- Education: Both buyer profiles include a mix of high school and college graduates.

Key Takeaways from the Four Makes and Models

Overall, each car model has its unique strengths and target demographics, allowing them to cater to a diverse range of consumer preferences and lifestyles. While all four buyer profiles show a trend towards active investing and a broad range of interests, their specific interests, purchasing habits, lifestyles, and card preferences differ significantly.

Tesla Buyers: “Affluent Cultural Connoisseurs.” Tesla buyers are typically liberal, financially secure, culturally aware males aged 35-75 who lead a sophisticated lifestyle. They’re interested in arts, current affairs, and collecting art and antiques. They shop online, own investment properties, and have premium credit cards like American Express. However, they’re less engaged in crafts, fitness activities, dieting, and watching baseball.

Prius Buyers: “Community-Oriented Suburban Families.” Prius buyers show interest in investing, technology, gardening, home improvement, and arts. They purchase women’s apparel, books, jewelry, and educational toys. They often work from a home office, cook at home, and have a professional woman in the household. Their hobbies include sewing, knitting, crocheting, collecting items, and traveling. They exhibit a strong sense of community through donations to the arts, community causes, and charities.

Leaf Buyers: “Diverse Intellectuals with Active Lifestyles.” Leaf buyers are diverse, career-focused individuals who manage personal investments and frequently make various types of purchases. They enjoy reading about science and space, watching sports on TV, home decorating, fitness, skiing, walking for exercise, and pet ownership. They support liberal political causes and enjoy attending the theater. They often have a professional woman or veteran in the household and are cardholders of American Express and Discover.

Volt Buyers: “Globally Aware Family-Focused Investors.” Volt buyers are active investors with diverse interests ranging from music and sports to technology and reading. They frequently purchase children’s apparel, health and beauty items, and home goods. Despite their diverse interests, they are less likely to engage in sport fishing or dog ownership. They also respond positively to mail offers, donate to arts and charities, and travel internationally.

Recommendations

Strategies for Auto Manufacturers to Better Target Distinct Markets

- Tesla: Given the wide demographic range, Tesla should continue to cater to both active seniors and families with teenagers. They could consider developing campaigns that highlight the versatility of their vehicles across different life stages. Additionally, with their buyers’ higher income levels and inclination towards luxury purchases, Tesla might benefit from partnerships with high-end brands for cross-promotion.

- Toyota Prius: As Prius mainly appeals to young couples transitioning into parenthood and middle-income families, marketing efforts could focus on the practical solutions their vehicles provide for families. For instance, they might emphasize safety features, fuel efficiency, and spacious interiors in their promotions.

- Nissan Leaf: With the younger demographic, Nissan Leaf could create campaigns highlighting their approachable and family-friendly brand image. They could also consider offering financial incentives or affordable financing options to attract urban young families with limited financial means.

- Chevrolet Volt: Chevy Volt, like Tesla, focuses on affluent suburban families seeking exclusivity and luxury living. They could consider emphasizing the luxury aspects of their vehicles, such as high-end finishes and advanced technology features, in their marketing efforts. Moreover, by showcasing how their cars cater to urban families with teenagers, they can further expand their market reach.

Suggestions for Future Research to Understand EV Buyer Behavior

- Spending Habits: Given the distinct spending habits observed, future research could delve deeper into understanding the motivations behind these behaviors. This could provide valuable insights into how EV manufacturers can better align their offerings with their target consumers’ preferences.

- Education and Income Levels: Further studies could explore the correlation between education, income levels, and the choice of EVs. This could help manufacturers tailor their marketing strategies to reach their target demographics more effectively.

- Geographical Preferences: Since location appears to play a role in EV preference, additional research could investigate the reasons behind this. For example, are certain brands more popular in urban areas due to their compact size or charging network? Understanding these dynamics could guide manufacturers in optimizing their distribution strategies.

Overall, these recommendations aim to provide a strategic direction for auto manufacturers and researchers in the EV industry to better understand and cater to their potential customers.

Conclusion

Purpose: The purpose of this study was to gain a deeper understanding of EV buyer behavior, enabling auto manufacturers to align their product offerings with consumer preferences and shape effective marketing strategies. The study aimed to identify distinct markets within the EV buyer population, which could aid in addressing the growing backlog of unsold electric vehicles.

Methodology: The study utilized a comprehensive dataset that captures purchase patterns for various makes and models of electric vehicles (EVs), including Tesla Models 3 & S, Toyota Prius, Nissan Leaf, and Chevrolet Volt. The American Lifestyles™ 2023 consumer classification system from Analyze360™ was used to segment the US population into 32 sociometric and psychographic clusters. Statistical techniques and machine learning algorithms, such as cluster analysis, decision tree analysis, and predictive modeling were employed to identify distinct categories of buyers and predict future buying behaviors.

Findings: The study revealed that each car model has unique strengths and target demographics. Tesla caters to a wide demographic range, including both active seniors and families with teenagers. Prius focuses on young couples transitioning into parenthood and middle-income families. Nissan Leaf targets a younger demographic, particularly families with infants and toddlers, as well as urban young families with limited financial means. Chevy Volt, like Tesla, focuses on affluent suburban families and urban families with teenagers.

Implications: These findings provide valuable insights for auto manufacturers. For example, Tesla could continue to develop campaigns that highlight the versatility of their vehicles across different life stages, while Prius could emphasize safety features, fuel efficiency, and spacious interiors. Nissan Leaf could offer financial incentives or affordable financing options to attract urban young families, and Chevy Volt could emphasize the luxury aspects of their vehicles in their marketing efforts.

Further research could delve deeper into understanding the motivations behind the distinct spending habits observed and explore the correlation between education, income levels, and the choice of EVs. Such insights could help manufacturers tailor their marketing strategies to reach their target demographics more effectively.

The understanding of Electric Vehicle (EV) buyer behavior is not just vital—it’s a lifeline for the future of the auto industry. As the world grows more environmentally conscious, the shift towards EVs is inevitable. However, this shift entails more than just manufacturing more electric vehicles. It involves understanding buyer motivations, preferences, and reservations, which are complex and varied. This understanding is imperative in tailoring not just marketing strategies, but also the vehicles themselves—design, features, price range—to the needs and wants of the consumer. The auto industry must invest in this understanding, for it is the key to driving success in the age of electric mobility. It is not just about predicting the market, but shaping it and steering it towards a sustainable future.

*American Lifestyles™ 2023 is designed to complement existing systems by providing a middle ground between the complex multivariate clustering systems like Mosaic USA, PRISM or Personicx that deliver large numbers of similar categories, and systems that offer only a few broad segments such as income or generational boundaries.

References

- https://www.marketsandmarkets.com/Market-Reports/electric-vehicle-market-209371461.html

- https://www.virta.global/en/global-electric-vehicle-market

- https://www.statista.com/topics/4421/the-us-electric-vehicle-industry/

- https://www.reuters.com/business/autos-transportation/slow-selling-evs-are-auto-industrys-new-headache-2023-07-11/

- https://www.caranddriver.com/features/g15377976/what-came-before-the-real-history-of-the-toyota-prius/

- https://www.porsche.com/stories/innovation/gamechanger-how-ferdinand-porsche-designed-first-hybrid-car

- https://www.energy.gov/articles/history-electric-car

- https://www.caranddriver.com/features/g43480930/history-of-electric-cars/

- https://techcrunch.com/2020/11/19/gm-ups-electric-and-autonomous-vehicle-spending-to-27-billion-through-2025/

- https://www.cnbc.com/2021/05/26/ford-boosts-electric-vehicle-spending-to-more-than-30-billion-aims-to-have-40percent-of-volume-all-electric-by-2030.html

- https://www.tesla.com/about

- https://onlinelibrary.wiley.com/doi/abs/10.1111/ijcs.12684

- https://www.sciencedirect.com/science/article/pii/S0148296322005410

- https://link.springer.com/article/10.1007/s11116-014-9567-9

- https://www.igi-global.com/chapter/an-integrative-approach-to-study-on-consumer-behavior-towards-plug-in-hybrid-electric-vehicles-revolution/173651

- https://www.sciencedirect.com/science/article/pii/S0301421512005162

Unleash the full potential of segmentation

Analyze360 is an affordable segmentation solution that harnesses the power of AI and data analytics to enhance your market research efforts. Effortlessly produce in-depth reports whenever you need them, and unleash the full potential of segmentation. Convert your customer or marketing lists into extensive, data-driven insights that unveil consumer behavior, lifestyles, demographics, and trends by leveraging more than 32 sociometric and psychographic clusters. Develop your own customer personas based on these insights and create campaigns that are sure to resonate with your target audience.

Need help interpreting your results?

Don’t have the manpower or marketing expertise to interpret the results Analyze360 provides into more actionable findings. We can help! Contact us to work with through your specific requirements.